Trickle-Down Economics: Myth or Reality?

Trickle-Down Economics: Myth or Reality?

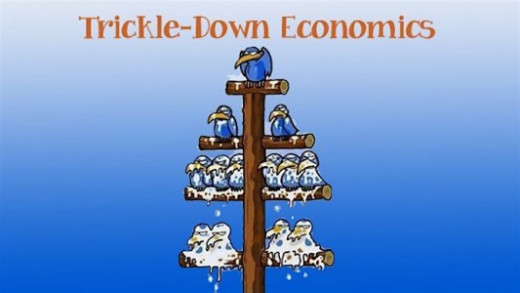

Picture this: a wealthy few at the top of society, showering their riches upon the masses below. The concept of "trickle-down economics" promises that as the rich get richer, everyone else will benefit from their prosperity. But is it truly a golden ticket to economic growth and equality? In this thought-provoking blog post, we'll dive into the history, pros and cons, and ultimately answer the burning question: does trickle-down economics really work? Get ready to challenge your assumptions and uncover the truth behind this controversial theory. Let's jump right in!

What is Trickle-Down Economics?

At its core, trickle-down economics is a theory that posits economic benefits for all when wealth and prosperity flow from the top down. Advocates argue that by reducing taxes on the wealthy and businesses, they are incentivized to invest more, create jobs, and ultimately stimulate economic growth. The idea is that as these investments and job opportunities increase, the benefits will "trickle down" to lower-income individuals and households.

However, critics of this theory raise valid concerns about its efficacy. They argue that instead of trickling down, wealth tends to accumulate at the top while leaving little impact on those at the bottom. Critics also point out that lowering taxes for the rich may disproportionately benefit them without guaranteeing any substantial gains for society as a whole.

Trickle-down economics has been championed by various politicians throughout history as a means to spur economic development. It gained significant traction during Ronald Reagan's presidency in the 1980s with his emphasis on tax cuts for corporations and high earners.

While proponents believe it can unleash entrepreneurial spirit and drive investment, opponents argue that it exacerbates income inequality by widening the gap between the rich and everyone else.

In essence, trickle-down economics rests upon an assumption: if we pour resources into those at the top of society's ladder, eventually everyone below will reap rewards. However, whether or not this promise holds true remains a subject of intense debate among economists and policymakers alike. In our quest for answers, let's examine both sides of this contentious argument before drawing any conclusions.

The History of Trickle-Down Economics

Trickle-Down Economics, a term coined in the 1980s, has its roots firmly planted in the Reagan era. President Ronald Reagan and his administration championed this economic theory as a way to promote growth and prosperity for all. The idea behind Trickle-Down Economics is that by giving tax breaks and incentives to businesses and wealthy individuals, they will invest more, create jobs, and ultimately benefit everyone.

However, the origins of this theory can be traced back even further. It draws inspiration from classical economists like Adam Smith who believed in laissez-faire capitalism - where government interference is minimal or non-existent. This concept gained traction during times of economic downturns when policymakers were searching for solutions to stimulate the economy.

Throughout history, Trickle-Down Economics has been both praised and criticized. Supporters argue that it encourages entrepreneurship and investment, leading to job creation and overall economic growth. Critics counter that it exacerbates income inequality by disproportionately benefiting the rich while neglecting the needs of lower-income individuals.

In recent decades, there have been several instances where Trickle-Down Economics was put into practice with varying outcomes. The Reagan era saw mixed results: some argue that it led to economic expansion while others believe it widened income disparities.

Today's ongoing discussions about wealth distribution are evidence of how contentious this topic remains. As societies strive for inclusive growth and social welfare programs gain popularity worldwide, questions arise about whether Trickle-Down Economics truly benefits society as a whole or if alternative approaches should be considered.

The history of Trickle-Down Economics provides valuable insights into its development over time but leaves us pondering its effectiveness in addressing long-standing issues such as income inequality and equitable wealth distribution without conclusive answers

Pros and Cons of Trickle-Down Economics

Trickle-down economics is a concept that has sparked much debate and controversy. Supporters of this theory argue that it can lead to economic growth by incentivizing the wealthy to invest, which in turn benefits the overall economy. They believe that when the rich have more money, they will spend and invest, creating jobs and opportunities for everyone.

On the other hand, critics point out several flaws in this approach. One major concern is income inequality. The wealthier individuals tend to benefit disproportionately from tax cuts or other policies aimed at stimulating economic growth. This can result in a wider gap between the rich and poor, potentially leading to social unrest.

Another criticism is that trickle-down economics may not always deliver on its promises. While proponents argue that tax breaks for businesses and high-income earners will stimulate job creation, there is no guarantee this will happen. In some cases, companies might prioritize profits over hiring new workers or investing in their communities.

Moreover, opponents highlight how trickle-down economics tends to overlook those at the bottom of society who are struggling financially. Critics say that focusing solely on providing benefits to top earners neglects programs like affordable housing or education initiatives which could help uplift lower-income individuals.

While trickle-down economics may have its proponents who argue it can boost economic growth, there are valid concerns about income inequality and whether it truly benefits all members of society equally. It's important to consider both sides before drawing any conclusions about its effectiveness as an economic theory

Does Trickle-Down Economics Work?

Trickle-down economics, often touted as a solution for economic growth and prosperity, has long been a source of debate among economists and policymakers. The theory behind trickle-down economics is that by cutting taxes on the wealthy and businesses, they will have more money to invest and create jobs, ultimately benefiting everyone in society.

However, critics argue that this approach primarily benefits the rich while failing to address income inequality or stimulate sustainable economic growth. They point out that instead of trickling down wealth to lower-income individuals, it often ends up concentrated at the top.

Furthermore, studies have shown mixed results when it comes to the effectiveness of trickle-down economics. While some research suggests a positive correlation between tax cuts for the wealthy and overall economic growth, others find minimal impact or even negative consequences.

Critics also highlight how trickle-down policies can exacerbate wealth disparities by reducing funding for public services such as education or healthcare – areas that directly benefit those in need.

Whether trickle-down economics works depends on various factors such as implementation strategies and country-specific circumstances. It's an ongoing discussion with no definitive answer but one thing remains clear: ensuring fair distribution of resources and supporting policies that promote inclusivity are vital aspects of any successful economic system.

In conclusion, after examining the history, pros, and cons of trickle-down economics, it is clear that this economic theory remains a subject of debate among economists and policymakers. While proponents argue that it promotes growth and job creation by incentivizing investment in businesses, critics contend that it exacerbates income inequality and fails to reach those at the bottom of the economic ladder.

While there may be instances where trickle-down economics has led to positive outcomes for certain sectors or individuals, its overall effectiveness in achieving widespread prosperity is questionable. The reality is that economic policies should strive for a balance between promoting business growth and ensuring equitable distribution of wealth.

Whether trickle-down economics works or not depends on various factors such as government regulations, taxation policies, and social safety nets. It cannot solely rely on market forces alone to address systemic issues such as poverty and inequality.

As society continues to grapple with these complex economic challenges, it becomes evident that a more comprehensive approach—one that incorporates both top-down measures like investments in education and infrastructure along with bottom-up strategies like targeted social programs—is necessary for fostering sustainable growth while also addressing societal disparities.

In conclusion (oops!), while some may still hold onto faith in the concept of trickle-down economics as an effective means of promoting prosperity for all members of society, its practicality remains uncertain. As we move forward into an increasingly interconnected world where inequality persists as a pressing issue, it becomes imperative to explore alternative approaches aimed at creating inclusive economies where everyone can thrive. Only through thoughtful analysis and open dialogue can we hope to shape truly impactful economic policies moving forward.

Comments

Post a Comment