From Boom to Bust: Understanding Economic Cycles and Their Impact

From Boom to Bust: Understanding Economic Cycles and Their Impact

Welcome, curious readers! Have you ever wondered why the economy goes through ups and downs? Why some years are marked by prosperity and growth while others bring hardship and decline? Well, prepare to dive into the fascinating world of economic cycles as we unravel the mysteries behind these fluctuating patterns.

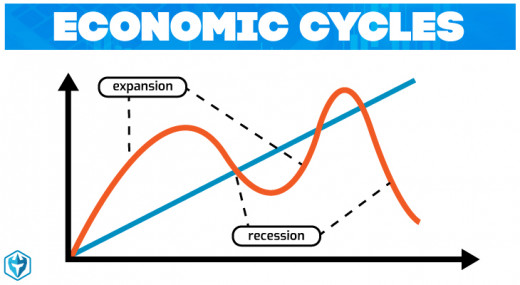

Economic cycles are like a dance—a never-ending rhythm of booms and busts that shape our financial landscape. In this blog post, we'll explore the four distinct phases of an economic cycle, discover what triggers these shifts, and uncover how past events have shaped our current economic climate. Plus, we'll equip you with valuable insights on how to safeguard yourself against potential downturns.

So fasten your seatbelts as we embark on a journey through time—to understand where we've been, where we are now, and where we might be heading in this rollercoaster ride called the economy. Let's get started!

What is an Economic Cycle?

What is an economic cycle? It's a question that often sparks confusion among many. Simply put, an economic cycle refers to the natural rise and fall of economic activity over time. Just like seasons change, so does the economy.

These cycles are characterized by alternating periods of expansion and contraction in key economic indicators such as GDP, employment rates, consumer spending, and business investments. They typically span several years or even decades and follow a predictable pattern.

The four phases of an economic cycle include expansion, peak, contraction (also known as recession), and trough. During the expansion phase, the economy experiences robust growth with increased production, rising employment rates, and optimistic investor sentiment.

At its peak, the economy reaches its highest point before transitioning into a period of contraction. This is when businesses face challenges such as declining sales and profits leading to layoffs.

During a recession or contraction phase, there is reduced consumer spending which further impacts businesses' bottom line resulting in decreased investments in capital projects or expansions.

Finally comes the trough - the lowest point in the cycle where things begin to stabilize before bouncing back towards recovery during another period of expansion.

Understanding these phases help economists predict trends within economies while giving individuals insight into potential risks or opportunities ahead. By being aware of where we stand within this cyclical ebb and flow can empower us to make informed decisions personally and professionally.

The Four Phases of an Economic Cycle

The four phases of an economic cycle can be likened to the seasons. Just as winter is followed by spring, and then summer and autumn, economies go through similar cycles. These phases are expansion, peak, contraction (or recession), and trough.

During the expansion phase, things are looking up. The economy grows at a steady pace, businesses thrive, and employment rates rise. It's like springtime when everything blossoms with potential.

Next comes the peak phase – the height of prosperity. This is when growth reaches its maximum point before starting to slow down. It's like the heat of summer where everything seems vibrant but also teetering on the edge.

Then comes contraction or recession – just like autumn when leaves start falling off trees. During this phase, economic activity slows down significantly. Businesses struggle to stay afloat and unemployment rises.

We reach the trough – akin to winter when nature lies dormant waiting for a new beginning. In this phase, economic activity hits rock bottom before slowly starting to recover once again.

Understanding these four phases helps us navigate economic cycles more effectively by recognizing where we stand currently and what may lie ahead in terms of opportunities or challenges.

Identifying Where we are in the Current Economic Cycle

Identifying where we are in the current economic cycle can be a challenging task. Economic cycles are not always predictable and often influenced by various factors such as government policies, global events, and market conditions. However, there are certain indicators that can help us understand the phase of the cycle we are currently experiencing.

One key indicator is GDP growth. When the economy is in an expansion phase, GDP tends to grow at a healthy rate. This indicates positive business sentiment, increased consumer spending, and overall economic prosperity. On the other hand, if GDP growth starts to slow down or decline for consecutive quarters, it could be indicative of an upcoming downturn.

Another important factor to consider is employment data. In an upswing phase of the cycle, job opportunities tend to increase as businesses expand their operations and hire more workers. Conversely, during a downturn or recessionary period, unemployment rates rise as companies lay off employees to cut costs.

Monitoring inflation levels also provides insights into the stage of the economic cycle. During periods of expansion, demand for goods and services increases which may lead to rising prices. Conversely, during a contraction phase with lower demand and decreased spending power among consumers and businesses alike can result in deflationary pressures.

Financial markets also offer clues about where we might be in the economic cycle. During times of optimism when investors anticipate future growth prospects; stock markets tend to rally while bond yields rise due to higher borrowing costs associated with stronger demand for credit.

Lastly but certainly not leastly - consumer confidence plays a vital role in identifying where we stand within an economic cycle! When consumers feel optimistic about their financial situation and have faith in future prospects they typically spend more which supports further growth! However; if uncertainty looms large leading individuals feeling uncertain anxiety this will likely have negative ramifications on our economy!

In summary, understanding where we are within an economic cycle helps us make informed decisions about investments personal finances & business strategies! While it's not always easy to pinpoint the exact phase of the cycle, analyzing indicators

What has Caused Previous Economic Booms and Busts?

What has caused previous economic booms and busts? This question has fueled numerous debates among economists, policymakers, and historians. The truth is that there isn't a single answer or a one-size-fits-all explanation for these complex phenomena. Instead, economic cycles are influenced by multiple factors that interact in intricate ways.

One common cause of economic booms is increased consumer spending. When people have more disposable income, they tend to buy more goods and services. This surge in demand stimulates production and leads to job creation. Additionally, technological advancements can also fuel an economic boom by increasing productivity and efficiency across industries.

Government policies also play a significant role in shaping the economy's trajectory. For instance, expansionary monetary policies such as lowering interest rates encourage borrowing and investment, which can lead to periods of rapid growth. Similarly, fiscal stimulus measures like tax cuts or increased government spending can stimulate aggregate demand.

However, booms inevitably give way to busts when unsustainable practices come into play. Excessive speculation in financial markets or the accumulation of debt beyond sustainable levels can trigger an abrupt downturn when reality catches up with inflated expectations.

External shocks such as natural disasters or geopolitical events can also disrupt economies and push them into recessionary territory. The 2008 global financial crisis serves as a stark reminder of how interconnected economies are today - what starts as a housing market collapse in the United States quickly spiraled into a worldwide recession.

Understanding the causes behind past economic cycles helps us navigate uncertain times better but predicting future cycles remains challenging due to their inherent complexity and unpredictability.

How can you Protect Yourself During an Economic Downturn?

During an economic downturn, it's important to take steps to protect yourself and your finances. Here are some strategies you can consider:

- Build an emergency fund: Having a cushion of savings is crucial during tough times. Aim to save at least three to six months' worth of living expenses in case of job loss or unexpected expenses.

- Reduce debt: Paying down high-interest debt will relieve financial stress and free up money for other necessities. Prioritize paying off credit cards and loans with the highest interest rates first.

- Diversify your income sources: Relying on a single source of income can be risky during an economic downturn. Consider taking on a side gig or exploring passive income streams to supplement your earnings.

- Cut back on discretionary spending: Trim unnecessary expenses and focus on essential items and services. Look for ways to save money on groceries, utilities, and entertainment without compromising quality of life.

- Invest wisely: During economic uncertainty, diversifying your investment portfolio is key. Consult with a financial advisor who can help guide you towards low-risk investments that align with your long-term goals.

- Cultivate new skills: Upskilling or reskilling yourself can enhance employability even in challenging times. Consider online courses or certifications that align with emerging industries or sectors less affected by economic fluctuations.

Remember that each individual's situation is unique, so tailor these suggestions based on your specific circumstances and goals.

In conclusion, understanding economic cycles is essential for individuals, businesses, and policymakers alike. These cycles are a natural part of the economy, characterized by alternating periods of expansion and contraction. By recognizing the four phases of an economic cycle and identifying where we currently stand in the cycle, we can better anticipate and prepare for potential boom or bust scenarios.

Previous economic booms have been fueled by factors such as technological advancements, increased consumer spending, and favorable government policies. However, these booms have inevitably given way to downturns caused by factors like financial crises or shifts in market conditions.

During an economic downturn, it is crucial to protect yourself financially. This may include diversifying your investments, building an emergency fund, reducing debt levels, and seeking out opportunities amidst uncertainty.

While it is challenging to predict exactly when the next boom or bust will occur with certainty, understanding the patterns of past economic cycles can provide valuable insights for informed decision-making in both personal finance and business planning.

So whether you're an individual looking to safeguard your finances or a business owner navigating market fluctuations, being aware of economic cycles can help you weather storms while capitalizing on opportunities during times of growth.

Remember that no two economic cycles are identical; each presents its unique challenges and opportunities. Staying informed about current events globally and locally will also enable you to gauge how external factors may impact future trends.

Knowledge about economic cycles empowers us to adapt our strategies prudently as we navigate through various phases – from boom to bust – in order to thrive even amid uncertain times.

Comments

Post a Comment