Keynes vs Hayek: Battle of Economic Theories

Keynes vs Hayek: Battle of Economic Theories

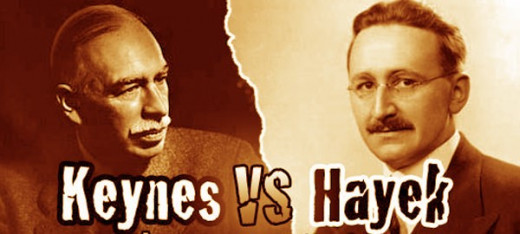

Step right up, ladies and gentlemen, as we witness an epic clash between two towering figures in the world of economics. In one corner, we have John Maynard Keynes, the advocate of government intervention and spending to stimulate economic growth. And in the other corner stands Friedrich Hayek, a staunch believer in free markets and limited government interference.

This is not your typical boxing match; it's an intellectual showdown that has captivated economists and policymakers for decades. So buckle up as we delve into the fascinating world of Keynesian and Hayekian economics - exploring their core principles, real-world applications, pros and cons, ultimately seeking answers to which theory reigns supreme.

Get ready for a ringside seat to witness this clash like never before! This battle will leave you with a deeper understanding of economic theories while igniting sparks of curiosity within your mind. Let's dive straight into the ring!

What are Keynesian and Hayekian Economics?

Keynesian and Hayekian economics are two prominent schools of thought that offer contrasting perspectives on how economies function and should be managed.

Keynesian economics, named after the influential economist John Maynard Keynes, emphasizes the role of government intervention in stabilizing economies. Keynesians argue that during times of economic downturns or recessions, governments should increase public spending and lower taxes to stimulate demand and boost economic growth. They believe that by injecting money into the economy, it can create a multiplier effect where increased consumer spending leads to more business activity and job creation.

On the other hand, Hayekian economics takes its name from Friedrich Hayek, a Nobel laureate economist known for his advocacy of free markets. Hayekians maintain that market forces are best left alone without excessive government interference. They assert that individuals acting in their own self-interests within competitive markets will result in efficient resource allocation and optimal outcomes for society as a whole.

While both theories share some common ground – such as recognizing the importance of savings - they diverge significantly when it comes to issues like inflationary control and fiscal policy. Keynesians tend to support active monetary policies (such as adjusting interest rates) while Hayekians favor rules-based monetary systems with minimal interventions.

These two economic theories have been central players in shaping policy decisions around the world since their inception. From Franklin D. Roosevelt's New Deal in response to the Great Depression employing Keynesian principles to Reaganomics' emphasis on tax cuts influenced by Hayek's ideas – each theory has found application at different points throughout history.

The Key Differences Between the Two Theories

Keynesian and Hayekian economics are two distinct schools of thought that have shaped the field of economics. While both theories seek to understand and explain economic phenomena, they differ in their approach and policy recommendations.

One key difference between Keynesian and Hayekian economics lies in the role of government intervention. Keynesians advocate for active government involvement to stabilize the economy during times of recession or depression. They believe that through increased public spending and monetary policies, such as lowering interest rates, governments can stimulate demand and promote economic growth.

On the other hand, Hayekians argue for limited government intervention in the economy. They emphasize the importance of free markets and individual liberty, asserting that excessive government interference hampers economic efficiency. According to this view, market forces should be allowed to allocate resources naturally without distortion from government interventions.

Another distinction lies in how each theory views money supply and its impact on inflation. Keynesians suggest that an increase in money supply can help boost economic activity by stimulating consumer spending. In contrast, Hayekians caution against excessive money creation as it may lead to inflationary pressures and distortions within an economy.

Additionally, these theories differ when it comes to understanding recessions or downturns in business cycles. Keynes argued that aggregate demand fluctuations are primarily responsible for recessions; thus, counter-cyclical policies like fiscal stimulus can help restore equilibrium. Conversely, Hayek believed that disruptions often stem from misallocations caused by previous expansions; therefore, allowing prices to adjust freely would enable a more efficient recovery process without governmental interference.

In practice, economies around the world have employed elements from both theories depending on specific circumstances or ideological inclinations prevailing at different times. For instance, during periods of financial crisis or deep recession (such as 2008), many countries adopted Keynesian-like policies aimed at boosting aggregate demand through increased public spending or tax cuts.

However, there has also been a resurgence of interest in Hayekian ideas, particularly in recent years. Advocates argue for reducing government regulation

How Keynesian and Hayekian Economics Have Been Applied in the Real World

Keynesian and Hayekian economics have both been applied in the real world, each with varying degrees of success.

In the aftermath of the Great Depression, Keynesian economics gained widespread acceptance as governments implemented policies aimed at stimulating demand through increased government spending and lower interest rates. This approach was exemplified by Franklin D. Roosevelt's New Deal in the United States.

On the other hand, Hayekian economics found its application in countries such as Chile under Augusto Pinochet's regime. The focus here was on free-market principles, deregulation, and privatization.

However, it is important to note that these applications were not without their challenges and criticisms. Keynesian policies have been criticized for potentially leading to inflationary pressures or creating unsustainable levels of public debt. In contrast, Hayek's emphasis on limited government intervention has faced criticism for exacerbating inequality and social disparities.

Despite these criticisms, both theories continue to be influential in shaping economic policy around the world today. Governments often adopt a mix of Keynesian and Hayekian approaches depending on specific circumstances or prevailing economic conditions.

Understanding how these different economic theories have been applied provides valuable insights into their strengths and weaknesses when put into practice across diverse global contexts.

The Pros and Cons of Each Approach

Pros and cons are inherent in every economic theory, and Keynesian and Hayekian economics are no exception. Both approaches have their strengths and weaknesses, which have been debated by economists for decades.

One of the main advantages of Keynesian economics is its focus on government intervention during economic downturns. By increasing government spending or cutting taxes, Keynesians believe that demand can be stimulated, leading to increased employment and economic growth. This approach has been credited with helping countries recover from recessions and preventing prolonged periods of high unemployment.

On the other hand, one criticism of Keynesian economics is its reliance on deficit spending. Critics argue that excessive government borrowing can lead to inflationary pressures and impose a burden on future generations through higher taxes or reduced public services.

In contrast, Hayekian economics emphasizes free markets as the most efficient allocators of resources. The belief is that individuals acting in their own self-interest will create a more prosperous society overall. This approach promotes limited government intervention and argues against attempts to manipulate the economy through monetary or fiscal policy.

However, one drawback of this approach is its potential to exacerbate income inequality. Without any redistribution mechanisms in place, wealth can become concentrated among a few individuals or corporations while leaving others behind.

Furthermore, proponents of Hayek's ideas often overlook market failures such as externalities or monopolies that require some level of regulation to ensure fair competition and maximize societal welfare.

It's important to note that both theories have been applied in various real-world contexts with varying degrees of success. For example, Keynesian policies were implemented during the Great Depression in the 1930s but faced challenges during stagflation in the 1970s. Similarly, Hayek's ideas influenced policymakers during periods such as Reaganomics in the United States.

Determining which economic theory is better depends on various factors including specific circumstances, political considerations,and long-term goals for an economy.

The ideal solution may lie somewhere between these two approaches, incorporating elements of both to strike a balance that promotes stability, growth

Which Economic Theory is Better?

The question of which economic theory is better, Keynesian or Hayekian, has sparked intense debate among economists and policymakers. Both theories offer compelling arguments and have been applied in different contexts with varying degrees of success.

Keynesian economics emphasizes the role of government intervention in stabilizing the economy during times of recession. According to this approach, increased government spending and fiscal policies can stimulate aggregate demand and promote economic growth. Proponents argue that such interventions can help mitigate unemployment and stabilize market fluctuations.

On the other hand, Hayekian economics advocates for a more laissez-faire approach, emphasizing free markets and limited government intervention. Hayek believed that allowing prices to freely adjust would lead to efficient resource allocation and long-term economic stability. Supporters argue that excessive government interference could distort market signals and hinder entrepreneurship.

In practice, both theories have had their successes and shortcomings. Keynesian policies were widely implemented during the Great Depression in the 1930s, helping to spur economic recovery. However, critics contend that prolonged reliance on deficit spending can lead to inflationary pressures or create future public debt burdens.

Hayek's ideas gained prominence during the post-World War II period when many countries embraced free-market principles. These policies contributed to rapid growth but also led to income inequality disparities in some cases.

Determining which theory is "better" ultimately depends on various factors such as specific economic conditions, political ideologies, cultural values, and social goals. It may not be possible or appropriate to make a blanket statement declaring one theory superior over another without considering these nuanced considerations.

Instead of seeking an outright winner between Keynesianism or Hayekism as if it were a black-and-white choice between two extremes – we should strive for a balanced understanding of these theories' strengths as well as their limitations.

Comments

Post a Comment