From Recessions to Recoveries: Understanding Economic Cycles

From Recessions to Recoveries: Understanding Economic Cycles

Welcome to the roller coaster ride of economic cycles! Just like seasons change, so does the economy. It goes through ups and downs, twists and turns, recessions and recoveries. Understanding these cycles is essential for businesses and consumers alike to navigate their way through the ever-changing landscape of financial markets.

In this blog post, we will dive deep into the world of economic cycles – what they are, how to identify them, their impact on businesses and individuals, as well as strategies for managing through them. So buckle up and get ready for a thrilling journey into the fascinating realm of economic fluctuations!

What is an Economic Cycle?

An economic cycle, also known as the business cycle, refers to the recurring pattern of expansion and contraction in an economy over time. It is a natural phenomenon that reflects the fluctuations in economic activity, such as production levels, employment rates, and overall growth.

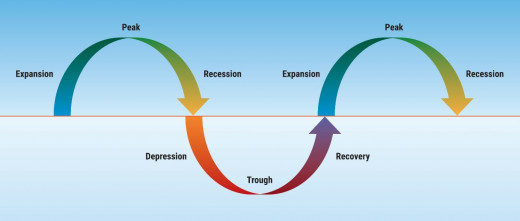

At its core, an economic cycle consists of four stages: expansion, peak, contraction (also known as recession), and trough. During the expansion phase, there is a rise in consumer spending and business investments. This leads to increased production and job creation. As the economy reaches its peak, it experiences maximum output and high levels of employment.

However, after reaching its zenith comes the inevitable contraction phase or recession. This period is characterized by a decline in economic activity – falling GDP growth rates, rising unemployment rates, reduced consumer spending – all leading to decreased production levels.

Eventually, the economy hits rock bottom at what's called the trough stage. At this point of maximum contraction or recessionary low point begins recovery - where economic indicators start picking up once again.

It's important to note that these cycles are not fixed intervals but rather vary in duration from several months to years depending on various factors like fiscal policies implemented by governments or external shocks like global recessions or financial crises.

Understanding these cyclical patterns can help businesses make informed decisions about investment strategies and resource allocation during different phases of an economic cycle. Similarly for individuals planning their personal finances; being aware of how these cycles impact employment prospects or income stability can be crucial for long-term financial security.

So now that we have a basic understanding of what an economic cycle entails let’s delve deeper into how one identifies these cycles! Stay tuned!

The Different Types of Economic Cycles

The economy is an ever-changing beast, constantly shifting and evolving. And just like the weather, economic conditions go through cycles. These cycles can be categorized into different types based on their characteristics and duration.

One type of economic cycle is known as a boom or expansion phase. This is when the economy experiences rapid growth, with increased production, high consumer spending, and low unemployment rates. Businesses thrive during this time and investors are eager to jump in.

On the flip side, there's also the bust or contraction phase. This occurs when there's a decline in economic activity, characterized by reduced production levels, decreased consumer spending, and rising unemployment rates. It's a challenging period for businesses as they struggle to stay afloat amidst declining demand.

Another type of economic cycle is called a recession. This is marked by significant declines in GDP (Gross Domestic Product) for two consecutive quarters or more. Recessions often result from factors such as financial crises or external shocks that disrupt normal business operations.

We have recovery phases which occur after recessions or contractions where the economy begins to stabilize and slowly regain strength. During this period, there may be cautious optimism among businesses and consumers as confidence gradually improves.

Understanding these different types of economic cycles is crucial for individuals and businesses alike because it allows them to anticipate changes in market conditions and make informed decisions accordingly. By recognizing whether an economy is booming or heading towards a downturn, companies can adjust their strategies to either capitalize on opportunities during prosperous times or weather the storm during periods of contraction.

It's important to note that these cycles don't follow a predictable pattern – their length varies from one cycle to another depending on various factors such as government policies, global events like wars or pandemics, technological advancements etc.

How to Identify an Economic Cycle

Economic cycles are an inevitable part of the economic landscape, and being able to identify them is crucial for businesses and consumers alike. But how exactly can we spot these cycles?

One key indicator of an economic cycle is fluctuations in gross domestic product (GDP). When GDP experiences a period of sustained growth over several consecutive quarters, it usually signifies an expansionary phase. Conversely, if GDP contracts for two or more quarters in a row, it indicates a recession.

Another important factor to consider when identifying economic cycles is employment data. During periods of expansion, unemployment rates typically decrease as businesses thrive and create more jobs. On the other hand, recessions often lead to job losses and higher unemployment rates.

Interest rates also play a significant role in discerning economic cycles. Central banks tend to lower interest rates during downturns to stimulate borrowing and spending, while they raise interest rates during periods of rapid growth to curb inflation.

Additionally, stock market performance can provide valuable insights into the state of the economy. Bull markets characterized by rising stock prices generally align with expansionary phases, whereas bear markets with declining prices indicate potential recessions.

To fully understand economic cycles requires monitoring various indicators simultaneously as no single measure provides a complete picture. By staying informed about GDP growth or contraction trends, employment figures, interest rate movements, and stock market performance - individuals and businesses can make better-informed decisions based on their specific circumstances.

The Stages of an Economic Cycle

The stages of an economic cycle can be likened to the ebb and flow of the tides. Just as waves crash onto the shore before receding back into the ocean, economies go through periods of expansion and contraction. Understanding these stages is crucial for businesses and consumers alike.

The first stage is known as a peak or boom. During this time, the economy is firing on all cylinders - unemployment rates are low, consumer spending is high, and businesses are flourishing. It's all sunshine and rainbows in this phase.

But what goes up must come down. The next stage is a recession or slowdown. This period sees a decline in economic activity, with GDP growth slowing or even turning negative. Unemployment rises as companies cut costs, leading to decreased consumer confidence.

After hitting rock bottom comes recovery. In this stage, signs of improvement begin to emerge - GDP starts growing again, employment levels stabilize, and consumer sentiment begins to rebound.

We have expansion or prosperity. This phase marks sustained economic growth with increasing business investment and rising wages for workers. It's like reaching the summit after climbing up from a deep valley.

Each stage has its own unique characteristics that impact both businesses and consumers differently. By understanding where we are in the economic cycle, individuals can make more informed decisions about investing their money or planning for future expenses.

Navigating through these stages requires adaptability and resilience from businesses who need to adjust their strategies accordingly while keeping an eye on market trends. For consumers too it means being cautious during times of recession but also taking advantage of opportunities during periods of growth.

In summary, understanding the stages of an economic cycle helps us comprehend how our financial landscape shifts over time - much like nature itself! By being aware of where we stand within these cycles, we can better prepare ourselves for potential challenges while capitalizing on opportunities presented by each respective stage

The Impact of an Economic Cycle on Businesses and Consumers

The impact of an economic cycle on businesses and consumers can be significant. During a recession, businesses may struggle to stay afloat as consumer spending decreases. This can lead to layoffs, reduced hours, or even closures.

For consumers, a downturn in the economy often means tightening their belts and cutting back on discretionary spending. Many individuals may experience job loss or wage cuts, making it difficult to afford non-essential items or services.

On the flip side, during an expansionary phase of the economic cycle, businesses tend to thrive as consumer confidence improves. Companies may see increased demand for their products or services and have more opportunities for growth.

Consumers also benefit during periods of economic growth as employment rates rise and wages increase. This allows individuals to feel more secure about their financial situation and have more disposable income to spend on goods and services.

However, it's important to note that not all sectors are affected equally by economic cycles. Some industries may be more resilient while others are highly sensitive to changes in the economy.

Understanding how economic cycles impact businesses and consumers is crucial for both parties in order to adapt strategies accordingly and make informed decisions about budgeting, investing, hiring practices, and overall financial stability.

Strategies for Managing Economic Cycle

- Diversify Your Portfolio: One of the most effective strategies for managing economic cycles is to diversify your portfolio. By spreading your investments across different asset classes, industries, and regions, you can minimize risk and increase the chances of capturing potential opportunities. Remember that not all sectors perform well during each phase of the cycle, so having a diverse mix ensures that you have some assets that may thrive while others may struggle.

- Stay Informed: Knowledge is power when it comes to navigating economic cycles. Keep yourself updated on market trends, policy changes, and global events that could impact the economy. This will help you make informed decisions about where to invest or which areas to avoid during specific phases of the cycle.

- Maintain a Long-Term Perspective: Economic cycles are inevitable, but they don't last forever. It's important to maintain a long-term perspective rather than being swayed by short-term fluctuations in the market. Stick with your investment strategy and resist making impulsive decisions based on temporary trends or news headlines.

- Build an Emergency Fund: Recessions often bring job losses and financial uncertainties for individuals and businesses alike. To weather these storms more effectively, build an emergency fund that can cover at least three to six months' worth of living expenses.

- Seek Professional Advice: If navigating economic cycles feels overwhelming or if you lack expertise in investing, consider seeking advice from a professional financial advisor who can guide you through various phases of the cycle based on your unique circumstances and goals.

Remember, there is no foolproof way to predict or control economic cycles entirely – even experts often differ in their forecasts! However, by implementing these strategies into your financial plan, you'll be better prepared to ride out any stormy periods while capitalizing on opportunities for growth during times of prosperity.

Comments

Post a Comment